Healthcare scheme

The Nuffield Health Healthcare Scheme provides you with access to treatment at Nuffield Health Hospitals, and the reassurance of knowing you’ll receive great quality care.

About this benefit

This scheme is provided through a healthcare trust and is administered on behalf of the Trustees by Bupa, who specialise in the management of Healthcare Trusts.

Your Healthcare Scheme is designed to pay for treatment of curable, short-term disease, illness or injury. Full details of the benefit provided including any limits and exclusions for certain benefits is detailed in the Bupa handbook will take effect from 1 January 2025. You can find a Bupa summary of benefits 2025 below under ‘Useful information’ detailing the scheme.

From 1 January 2025, there will no longer be full eligibility for all employees to join the Healthcare Scheme – the criteria for joining will be based on the number of hours worked per week, job family and grade. Bank staff, Hospital Consultants and Self-Employed staff are not eligible to join.

How to join

If you are a new employee, you can join the scheme within the first three months from starting with Nuffield Health. You will receive a prompt to join the Healthcare scheme as part of your on-boarding tasks within Workday. Nuffield Health will pay for a single membership (unless noted differently in your contract of employment).

How to join (Acquired Sites only)

If you are an Acquired Sites employee, you can join the scheme within the first three months from starting with Nuffield Health, or during the open enrolment period. You can join by completing the Healthcare application form Form.

How to make changes

As an existing member, you can make changes to your membership.

- Within three months of joining the organisation

- During the annual enrolment window (usually November/December)

- Within three months following a qualifying lifestyle event

When making changes due to a lifestyle event you will need to upload evidence of this event and provide a comment (refer to Workday Quick Reference Guide). This will then be reviewed for eligibility and approved if it meets criteria.

How to add or change dependents

Refer to the Workday Quick Reference Guide for more information on how to add dependents. If you are adding or changing dependents on your Healthcare scheme, any pre-existing medical conditions/symptoms that your dependents have will be excluded from treatment under the scheme for a period of two years.

What happens next

Applications are processed on a monthly basis, and they will be effective from the 1st of the following month. You will receive a letter from the scheme administrator confirming details of your membership once your application has been approved and processed, typically within the first 3-4 weeks of the following month.

How to get in touch

From 1 January 2025, if you have any queries regarding a claim or your policy, please call the BUPA team on 0800 028 7687.

You can also email the team at nuffieldhealth@bupa.com.

Useful information

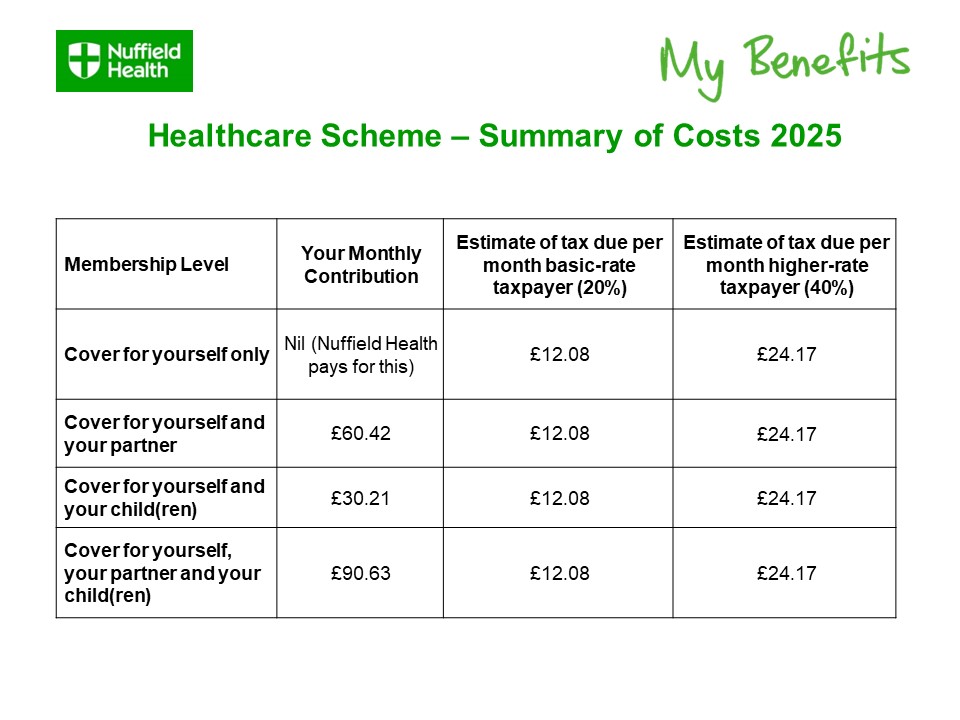

- Healthcare scheme - Summary of costs 2025

- Healthcare scheme - Summary of benefits 2025

- BUPA Healthcare scheme webinar

- BUPA Handbook 2025

FAQs

-

Who can apply to join the scheme?

From 1 January 2025, there will no longer be full eligibility for all employees to join the Healthcare Scheme – the criteria for joining will be based on the number of hours worked per week, job family and grade.

Eligible Employees Clinical Job Family You work in a clinical role for at least 2 full working days per week* Non-Clinical Job Family You work in a non-clinical role for at least 2 full working days per week* and your role is Grade 8 or above. *15 hours for 37.5 hour week or 16 hours for 40 hour week

Bank staff, hospital consultants and self-employed staff are not eligible to join.

-

How much does it cost to join the scheme and is the benefit taxable?

From January 1 2025, the cost of single membership is £60.42 per month and is paid for by Nuffield Health (unless noted differently in your contract of employment). However, you are liable for income tax on the amount Nuffield Health pays, known as a taxable benefit.

Nuffield Health will process this taxable benefit for you through the monthly payroll. This means that all tax reporting is done through payroll and so there will be no need to declare your medical cover on a P11d at the end of the tax year. -

Can I add family members to the scheme?

You can choose to add your partner and/or child(ren) to your scheme at your own cost - i.e. you pay the membership contributions yourself via payroll deduction – Nuffield Health will not pay these for you (unless noted differently in your contract of employment). From 1 January 2025 monthly costs for dependants are £60.42 for a partner, £30.21 for child(ren) (for any number of children) or £90.63 for a partner and child(ren). You can view a more detailed summary of costs here. Please note, parents are not eligible to add as family members to the scheme.

To add a dependant, you must request this via the Workday Benefits application. Changes can be made to your healthcare scheme within 3 months of qualifying lifestyle events, a full list of which can be found here. When making changes due to a lifestyle event you will need to upload evidence of this event.

Any pre-existing medical conditions/symptoms that your dependants have will be excluded from treatment under the scheme for a period of two years. -

How long can children remain in the scheme?

Child dependants registered on the scheme will be covered until the end of the scheme year in which they reach the age of 25.

-

Are pre-existing conditions covered in the scheme?

Pre-existing eligible conditions are covered on joining the scheme for employees and there is no medical history questionnaire to complete to join. However, if you add a dependant to the scheme, any pre-existing medical conditions/symptoms that your dependants have will be excluded from treatment under the scheme for a period of two years.

-

Do I need to pay anything towards any claims I make?

Every scheme member including dependants, pays the first £150 of any claim in each scheme year that they have a consultation or receive treatment, this is called an excess. The scheme year runs from January to December.

The excess amount will need to be paid by you direct to the healthcare provider. Bupa Healthcare will deduct this amount from the first invoice(s) paid and will write to you to confirm the amount you need to pay and to whom. -

If my claim continues into another scheme year, will I have to pay two excesses?

For 2025, the £150 excess is payable just once in a 12-month period from the start of the treatment.

This means that you won't necessarily need to pay it at the beginning of the scheme year, but you may need to pay another excess if your treatment continues for more than a year. For 2025, we will be changing to a £150 excess per person per year. -

Is the Healthcare Scheme a taxable benefit?

Yes, you pay tax on the amount Nuffield Health pays for your healthcare cover - this is known as a taxable benefit and is processed through the monthly payroll for you. It is shown on your payslip as "Healthcare”. You can view a summary of costs here.

-

Will I receive a P11d for my healthcare benefit?

No, because the benefit in kind tax is processed for you through the monthly payroll there is no need to report the amount separately to HMRC at tax year end and as such there will be no P11d form issued for healthcare benefits.

-

What happens in an emergency?

If you have an accident or are taken seriously ill, you should seek emergency treatment under the NHS. In these instances, the NHS provides the best treatment available.

-

Can I move from the NHS to a private room following an accident or emergency?

Following emergency admission to the NHS and at the appropriate time, arrangements may be made should you wish to transfer to a Nuffield network hospital, dependent on your suitability to transfer and the availability of a Nuffield network facility that can provide the treatment required.

Bupa Healthcare requires approval from the specialist treating you and you should contact the Helpline to confirm if this benefit is available to you. -

Which hospitals can be used?

You have access to the highest quality care at Nuffield Health hospitals. If you need treatment that cannot be provided at one of these hospitals, or you live more than 25 miles from one of them, you may be able to have treatment at another private hospital or NHS private ward. Bupa will confirm this with you when you call to authorise your claim.

-

Is this benefit available outside the UK?

No, the scheme does not pay for treatment overseas. We strongly recommend that you buy travel insurance before you go abroad.

-

Can I leave the scheme if I no longer wish to be a member?

You may voluntarily leave the scheme or remove dependants from your scheme ahead of the scheme renewal date each year (1 January) or within three months of a qualifying lifestyle event via Workday - Benefits application.

*Full details about what is defined as a qualifying lifestyle event can be found here. If you need further clarification, please contact the Benefits team on psc@nuffieldhealth.com -

What happens if I leave Nuffield Health can I continue my medical cover?

If you leave Nuffield Health, your healthcare cover will cease on your last working day (leaving date). If you are currently a member of the scheme and would like healthcare cover under a separate agreement at your own expense upon leaving/retiring, you can contact Willis Towers Watson team on 0800 083 0706 or email them at hbgb.pip@willistowerswatson.com and an adviser will get in touch to provide a quote and talk through the options with them. The team will respond, typically within 3-5 working days. For more information, please refer to the leavers brochure.

-

I am leaving Nuffield Health but mid-treatment, what should I do?

If you are leaving Nuffield Health you should contact Willis Towers Watson team on 0800 083 0706 or email them at hbgb.pip@willistowerswatson.com and an adviser will get in touch to provide a quote and talk through the options with them confirming your date of leaving and provide a contact number as well as email address. Please refer to the leavers brochure for further information.

-

Who should I contact for further information?

Should you have any further questions, please do not hesitate to email the MyBenefits Team at psc@nuffieldhealth.com or alternatively contact the Nuffield Health Team at Bupa on 0800 028 7687.